Education Tax Credits and Deductions

For parents and students trying to manage college bills and student loan payments, the federal government offers education-related tax benefits. The requirements for each are different, so here’s what you need to know.

American Opportunity credit

The American Opportunity credit (formerly the Hope credit) is a tax credit available for the first four years of a student’s undergraduate education, provided the student is attending school at least half-time in a program leading to a degree or certificate. The credit is worth up to $2,500 in 2022 (it’s calculated as 100% of the first $2,000 of qualified expenses plus 25% of the next $2,000 of expenses). The credit must be taken for the tax year that the expenses are paid, and parents must claim their child as a dependent on their tax return to take the credit.

To be eligible for the credit, your income must fall below certain limits. In 2022, a full credit is available to single filers with a modified adjusted gross income (MAGI) below $80,000 and joint filers with a MAGI below $160,000. A partial credit is available to single filers with a MAGI between $80,000 and $90,000 and joint filers with a MAGI between $160,000 and

$180,000.

One benefit of the American Opportunity credit is that it’s calculated per student, not per tax return. So parents with two (or more) qualifying children in a given year can claim a separate credit for each child (assuming income limits are met).

The mechanics of claiming the credit are relatively easy. If you paid tuition and related expenses to an eligible educational institution during the year, the college generally must send you a Form 1098-T by February 1 of the following year. You then file Form 8863 with your federal tax return to claim the credit.

Lifetime Learning credit

The Lifetime Learning credit is another education tax credit, but it has a broader reach than the American Opportunity credit. As the name implies, the Lifetime Learning credit is available for college or graduate courses taken throughout your lifetime (the student can be you, your spouse, or your dependents), even if those courses are taken on a less than half-time basis and don’t lead to a formal degree. This credit can’t be taken in the same year as the American Opportunity credit on behalf of the same student.

The Lifetime Learning credit is worth up to $2,000 in 2022 (it’s calculated as 20% of the first $10,000 of qualified expenses). The Lifetime Learning credit must be taken for the same year that expenses are paid, and you must file Form 8863 with your federal tax return to claim the credit. In 2022, a full credit is available to single filers with a modified adjusted gross income (MAGI) below $80,000 and joint filers with a MAGI below $160,000. A partial credit is available to single filers with a MAGI between $80,000 and $90,000 and joint filers with a MAGI between $160,000 and $180,000.

Unlike the American Opportunity credit, the Lifetime Learning credit is limited to $2,000 per tax return per year, even if more than one person in your household qualifies independently in a given year. If you have more than one family member attending college or taking courses at the same time, you’ll need to decide which credit to take.

Example: Joe and Ann have a college freshman and sophomore, Mary and Ben, who are attending school full-time. In addition, Joe is enrolled at a local community college taking two graduate courses related to his job. Mary and Ben each qualify for the American Opportunity credit. Plus, Mary, Ben, and Joe each qualify for the Lifetime Learning credit.

Because the American Opportunity credit isn’t limited to one per tax return, Joe and Ann should claim this credit for both Mary and Ben, and then claim a Lifetime Learning credit for Joe. Joe and Ann can claim both the American Opportunity credit and the Lifetime Learning credit in the same year because each credit is taken on behalf of a different qualified student.

Student loan interest deduction

The student loan interest deduction allows borrowers to deduct up to $2,500 worth of interest paid on qualified student loans. Generally, federal student loans, private bank loans, college loans, and state loans are eligible. However, the debt must have been incurred while the student was attending school on at least a half-time basis in a program leading to a degree, certificate, or other recognized educational credential. So loans obtained to take courses that do not lead to a degree or other educational credential are not eligible for this deduction.

Your ability to take the student loan interest deduction depends on your income. For 2022, to take the full $2,500 deduction (assuming that much interest is paid during the year) single filers must have a MAGI of $70,000 or less and joint filers $145,000 or less. A partial deduction is available for single filers with a MAGI between $70,000 and $85,000 and joint filers with a MAGI between $145,000 and $175,000.

Also, to be eligible for the deduction, an individual must have the primary obligation to pay the loan and must pay the interest during the tax year. The deduction may not be claimed by someone who can be claimed as a dependent on another taxpayer’s return. Borrowers can take the student loan interest deduction in the same year as the American Opportunity credit or Lifetime Learning credit, provided they qualify for each independently.

Tuition and fees deduction

The deduction for tuition and fees is not available in 2022. It was last available in 2020, when it was worth up to $4,000 for out-of-pocket qualified tuition and fee expenses paid during the year. Single filers with a modified gross income (MAGI) of $65,000 or less and joint filers with a MAGI of $130,000 or less could take the full $4,000 deduction. A $2,000 partial deduction was available for single filers with a MAGI between $65,000 and $80,000 and joint filers with a MAGI between $130,000 and $160,000.

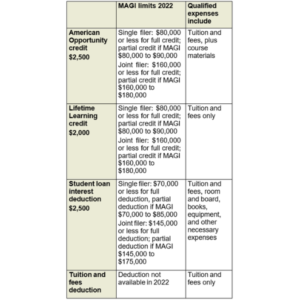

Comparison of Credits/Deductions

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal professional.

LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

This article was prepared by Broadridge.

LPL Tracking #1-05095040